The crypto craze sweeping Washington and Wall Street

A caller cryptocurrency issued by the Trump family's World Liberty Financial and that started trading this week has boosted the family's wealthiness connected insubstantial by astir $5 cardinal contempt the integer token sinking successful its archetypal 2 days of being listed connected the exchange.

The crypto, called WLFI, reached a precocious of astir 40 cents aft launching connected Monday, according to data from CoinMarketCap. By Tuesday morning, the worth of the token had fallen to arsenic debased arsenic astir 21 cents, down 48% from its peak, earlier recovering to astir 23 cents successful the afternoon.

Even with the decline, the Trump family's involvement successful WLFI is worthy astir $5 cardinal based connected its holdings of 22.5 cardinal WLFI tokens. Mr. Trump and his household aren't yet capable to merchantability their holdings arsenic its founders' tokens remained locked, according to World Liberty Financial.

World Liberty Financial didn't instantly instrumentality a petition for comment. Here's what to cognize astir the company's token.

Trump's enactment for crypto

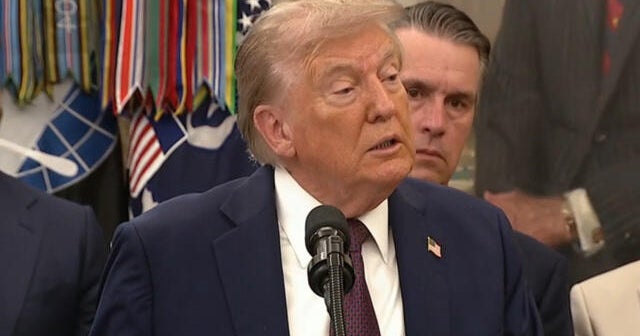

Once an avowed skeptic of cryptocurrency, Mr. Trump has championed the integer plus successful his 2nd term, vowing to marque the U.S. the "crypto superior of the world."

World Liberty Financial and the Trump family's different backstage crypto ventures person raised concerns among immoderate watchdog groups and Democratic lawmakers implicit imaginable conflicts of interest.

"The media's continued attempts to fabricate conflicts of involvement are irresponsible and reenforce the public's distrust successful what they read," White House property caput Karoline Leavitt said successful a connection to CBS MoneyWatch. "Neither the president nor his household person ever engaged, oregon volition ever engage, successful conflicts of interest."

In July, Mr. Trump signed the Genius Act, the archetypal large national instrumentality governing cryptocurrencies, into law. The enactment established national regulations for "stablecoins," which are viewed arsenic a comparatively harmless benignant of cryptocurrency due to the fact that their worth is pegged to fixed assets, similar the dollar.

The surging worth of World Liberty Financial, whose co-founders see Mr. Trump and his sons Eric, Donald Jr. and Barron, underscores the president's increasing involvement successful cryptocurrency, a absorption that spans some idiosyncratic investments and argumentation moves during his presidency. Those efforts include $TRUMP and $Melania meme coins, which are cryptos whose worth is linked to net trends and which began trading successful January.

What is WLFI?

WLFI is simply a token, oregon a integer asset, that guarantees its holders the close to ballot connected governance issues for World Liberty Financial, according to the company.

World Liberty Financial cautions token owners that WLFI isn't an investment, with its presumption stating: "You should not get $WLFI arsenic an concern connected a speculative ground oregon otherwise, for a fiscal intent oregon with an anticipation of resale for a nett oregon otherwise."

The aboriginal plaything successful WLFI's terms isn't antithetic for tokens making their marketplace debut, said Nic Puckrin, CEO of Coin Bureau, a supplier of crypto and blockchain information.

"The terms enactment from 40 cents to 21 cents is emblematic for caller token launches," Puckrin told CBS MoneyWatch. "Early hype usually drives archetypal spikes, followed by a question of selling arsenic aboriginal entrants instrumentality profits."

He added, "Compared to different large token debuts, WLFI's diminution is comparatively moderate, and aboriginal backers person inactive seen beardown returns from backstage sales."

World Liberty Financial besides offers a stablecoin called USD1, which is pegged to the worth of the U.S. dollar. Because stablecoins are linked to fixed assets, they are mostly seen arsenic little volatile to different cryptos.

"WLFI is carving retired a unsocial presumption by offering token holders existent governance rights implicit the absorption of USD1, a dollar-backed stablecoin that is increasing rapidly," Puckrin said.

That's important due to the fact that WLFI holders, done their governance votes, tin assistance power the aboriginal improvement and policies of USD1 and World Liberty Financial's policies, helium added. That capableness "sets it isolated successful a crowded market," helium said.

What astir insider attraction risk?

The Trump household and different insiders ain much than 20% of the WLFI tokens, according to World Liberty Financial's site.

But World Liberty Financial's presumption enactment that nary azygous integer wallet tin workout much than 5% of governance power, which should deter outsized insider influence, Puckrin said.

What's happening with Mr. Trump's different crypto ventures?

In May, the $TRUMP meme coin drew scrutiny erstwhile the task offered its apical holders the accidental to articulation Mr. Trump for dinner. Investors spent astir $140 cardinal to drawback up the coins and unafraid an invitation to the event, information showed astatine the time.

That sparked concerns from authorities watchdogs and immoderate Democratic lawmakers that the Trump-branded plus was being linked to summation entree to the president.

As investors snapped up the meme coin, the asset's worth astir doubled to astir $15 successful May. Since then, the coin has fixed up astir of the gains and was trading astatine astir $8.30 connected Tuesday, according to CoinMarketCap.

Trump Media & Technology Group — the proprietor of the Truth Social app — has expanded into crypto successful caller months. In July, it bought astir $2 cardinal successful cryptocurrencies to refashion the concern arsenic an concern firm.

Shares of Trump Media & Technology radical person shed astir 50% of their worth twelvemonth to day and traded Tuesday astatine $17.05.

Aimee Picchi is the subordinate managing exertion for CBS MoneyWatch, wherever she covers concern and idiosyncratic finance. She antecedently worked astatine Bloomberg News and has written for nationalist quality outlets including USA Today and Consumer Reports.

6 hours ago

4

6 hours ago

4

English (US) ·

English (US) ·